When it comes to digital marketing and marketing in general, there are a number of metrics and KPIS that are used to measure the effectiveness of various campaigns. Most commonly, these metrics usually prioritize return on investment. For example, how much money do you make for every dollar you spend (short-term or long-term). When looking at what KPIs we should be focused on, there are two (2) that come to mind and one (1) to double down on.

Digital Marketing KPIs: Return on Ad Spend (ROAS) – Short-term

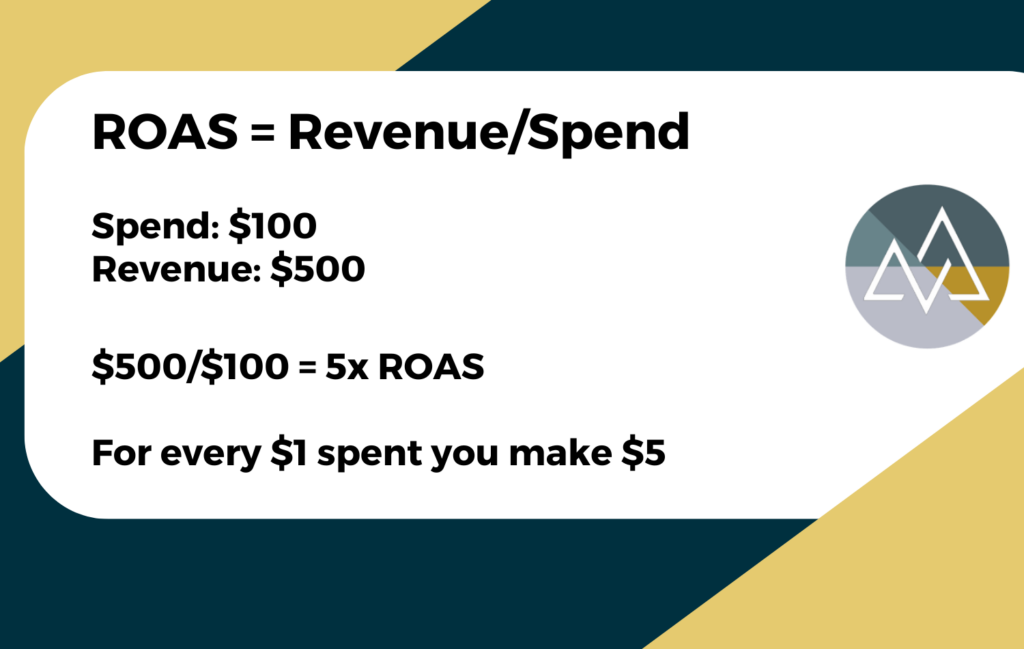

ROAS, also known as Return on Ad Spend stands for the return on your advertising spend. Specifically, ROAS is used to measure the revenue generated by a specific advertising campaign compared to the cost of that campaign. The ROAS is calculated by dividing the revenue generated by the campaign by the cost of the campaign. For example, if a company spends $100 on an advertising campaign and generates $500 in revenue as a result, the ROAS for that campaign is 5x ($500/$100 = 5). In short, this means that for every $1.00 you spend you make $5.00.

ROAS is an important KPI because it helps businesses understand the effectiveness of their marketing efforts. Additionally, it offers guidance on how and where businesses should be allocating dollars. For example, if a Facebook Ad is yielding a 5x ROAS and Google Ads is yielding a 0.99x ROAS, it would make sense for the business to double down on Facebook Ads and cut out Google Ads. Why? Well, for a $1.00 they spend on Facebook Ads, they make $5.00 (5x ROAS). Whereas, with Google Ads for every $1.00 they spend they make $0.99 (0.99x ROAS).

In summary, a high ROAS indicates that a company is generating more revenue than it’s spending. A low ROAS indicates that the company is not generating enough revenue to justify the cost of the particular advertising campaign. At the end of a day a business can’t spend $1.00 to make $0.99. But, it can justify spending $1.00 to make $5.00 (in 99% of cases). According to Nielsen, the average ROAS across all industries (midsize brands) for paid advertising is 2.87x. Or, for every $1.00 that is spent on advertising, the company will make $2.87. It’s important to note that for ecommerce, the average is ~4x ROAS.

Digital Marketing KPIs: Customer Acquisition Cost/Lifetime Value (LTV/CAC) – Long-term

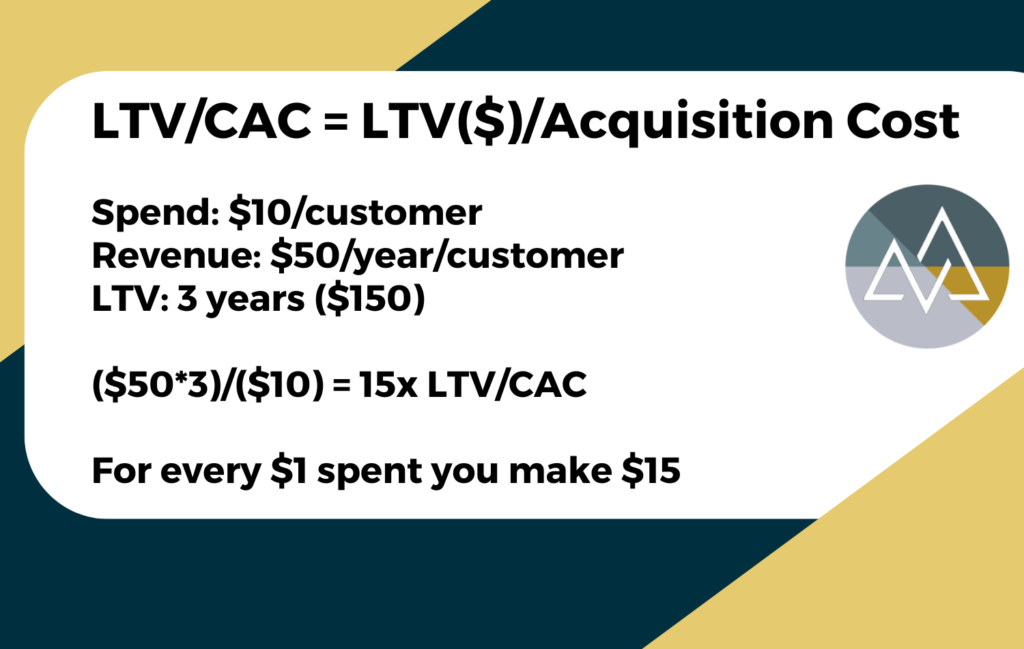

LTV/CAC, is also known as the lifetime value (LTV) to customer acquisition cost (CAC). LTV/CAC stands for how much a customer will generate your business over the course of their relationship with you versus the cost to acquire that customer. To expand quickly, the LTV (lifetime value) is the estimated total revenue that a customer will generate over the course of their relationship with the company. CAC (customer acquisition cost) is calculated by dividing the total cost of acquiring new customers (i.e. advertising spend) by the number of new customers acquired during a specific period of time. For example, if a company is acquiring customers (CAC) for $10.00 per customer and the average customer spends at least $50 per year for 3 years, the LTV/CAC would be (($50 * 3)/$10) = 15x (15:1 = $15 in revenue for every $1 spent).

Similar to ROAS, LTV/CAC is an important long-term KPI for understanding how your advertising campaigns are performing. It also offers guidance (similar to ROAS) on where to allocate advertising dollars. For example, if a Facebook Ad is yielding a 5x LTV/CAC and Google Ads is yielding a 0.99x LTV/CAC, it would make sense for the business to double down on Facebook Ads and cut out Google Ads. Why? Well, for a $1.00 they spend on Facebook Ads, they make $5.00 (5:1 LTV/CAC). Whereas, with Google Ads for every $1.00 they spend they make $0.99 (0.99:1 LTV/CAC).

According to Chargebee, the average LTV/CAC across all industries for advertising is 3x. Or, for every $1.00 (CAC) that is spent on advertising, the company will make $3.00 (LTV).

Should you focus on ROAS or LTV/CAC?

At the end of the day, this is entirely up to the business and its objectives/goals (OKRs). It’s also important to consider the type of campaign your measuring against. Is it a short-term (seasonal, discount, etc.) advertising campaign or a long-term (brand) advertising campaign? The reason you should consider the timeframe is because your willingness to spend may be attached to the timeframe in which you’re able to spend. For instance, ROAS might be a great KPI for short-term, seasonal campaigns. Whereas, LTV/CAC might be the preferred KPI for long-term campaigns. Let’s dive into why we prefer using LTV/CAC especially when it relates to paid advertising.

We prefer to use LTV/CAC as the primary KPI due to the fact that it takes into the account the entire relationship between the company and the customer rather than just one (1) conversion touch point (ROAS). This means that LTV/CAC is a much better KPI for companies that are looking to build long-term relationships with their customers rather than one-off transactions. Simply put, LTV/CAC can help businesses make more informed decisions about how to allocate resources and scale, profitably.

Here is a quick use case where ROAS could derail a rather profitable advertising campaign long-term

Imagine a business that sells a subscription service for $50 per month. Let’s say that the average customer stays subscribed for 24 months, generating a total lifetime value (LTV) of $1,200 ($50*12*2). Now, let’s say that the business spends $300 to acquire each new customer.

If we calculate the LTV/CAC ratio, we get:

LTV/CAC = $1,200 / $300 = 4x

This means that for every dollar the business spends on customer acquisition, they can expect to generate $4 in revenue over the long term.

Now, let’s calculate the ROAS for the business. Let’s say they run a marketing campaign that costs $5,000 and generates $10,000 in revenue. The ROAS would be:

ROAS = $10,000 / $5,000 = 2x

This means that for every dollar the business spends on the marketing campaign, they earn $2 in revenue.

At first glance, it might seem like the marketing campaign is not very profitable, since the ROAS is only 2x. However, when we look at the LTV/CAC ratio, we see that the business is actually acquiring customers at a highly profitable rate (4x).

In short, ROAS can be great for short-term (quick money-making campaigns) advertising campaigns. With that said, it shouldn’t be the KPI that you rely on to measure long-term campaign success. As for the example above, LTV/CAC will give you transparency and clarity around campaign success.